The smart choice for safeguarding your identity

Don't wait to become a victim of identity theft, get protected today. Get ID TheftSmart and let licensed investigators protect your identity, detect fraudulent activity, and restore your peace of mind in the event you fall victim to identity theft.

What is Identity Theft?

Identity theft is a crime. This crime occurs when someone invades your life, taking pieces of your private identifying information and assumes it as his/her own, thereby causing damage to your credit, as well as your name.

The information can be used to obtain credit, merchandise, and services in the name of the victim, or to provide the thief with false credentials. In addition to running up debt, in rare cases, an impostor might provide false identification to police, creating a criminal record or leaving outstanding arrest warrants for the person whose identity has been stolen.

ATTENTION ID THEFTSMART CLIENTS:

Due to a recent change to the ID TheftSmart platform all existing clients will need to set up their account credentials on the new ID TheftSmart portal. If you have any questions, please contact us your local branch or contact ID TheftSmart directly at 855-848-8803.

Due to a recent change to the ID TheftSmart platform all existing clients will need to set up their account credentials on the new ID TheftSmart portal. If you have any questions, please contact us your local branch or contact ID TheftSmart directly at 855-848-8803.

Our goal is to help you protect your personal and financial information

We've partnered with Kroll, an industry leader in ID Theft Protection and Restoration, to provide you with several options to monitor, detect, and restore your identity should you ever become a victim of identity theft. We offer 3 levels of protection to meet your needs:

Identity Management Services

- Fees: $5 per month

- Services:

-

- ID Theft Counseling

- ID Theft Restoration

- Monitoring: Self Monitoring

- Alerts: None

- Notification Delivery: N/A

Single Bureau Credit Monitoring

- Fees: $8 per month

- Services:

-

- ID Theft Counseling

- ID Theft Restoration

- Credit Monitoring of Single Credit Bureau (Experian)

- Monitoring: Experian Credit Bureau

- Alerts:

-

- New Accounts Opened

- Payment Delinquencies

- Credit Inquiries

- Public Record Changes

- Address Changes

- Notification Delivery:

-

- Online (Email Required) or

- Offline (Postal Delivery)

Full Credit Monitoring

- Fees: $12 per month

- Services:

-

- ID Theft Counseling

- ID Theft Restoration

- ID Integrity Scan

- Credit Monitoring of all 3 Credit Bureaus

- Monitoring:

-

- Experian Credit Bureau

- TransUnion Credit Bureau

- Equifax Credit Bureau

- Alerts:

-

- New Accounts Opened

- Payment Delinquencies

- Credit Inquiries

- Public Record Changes

- Address Changes

- Web Watcher Scan

- Public Persona Scan

- Address Aware Scan

- Notification Delivery:

-

- Online (Email Required)

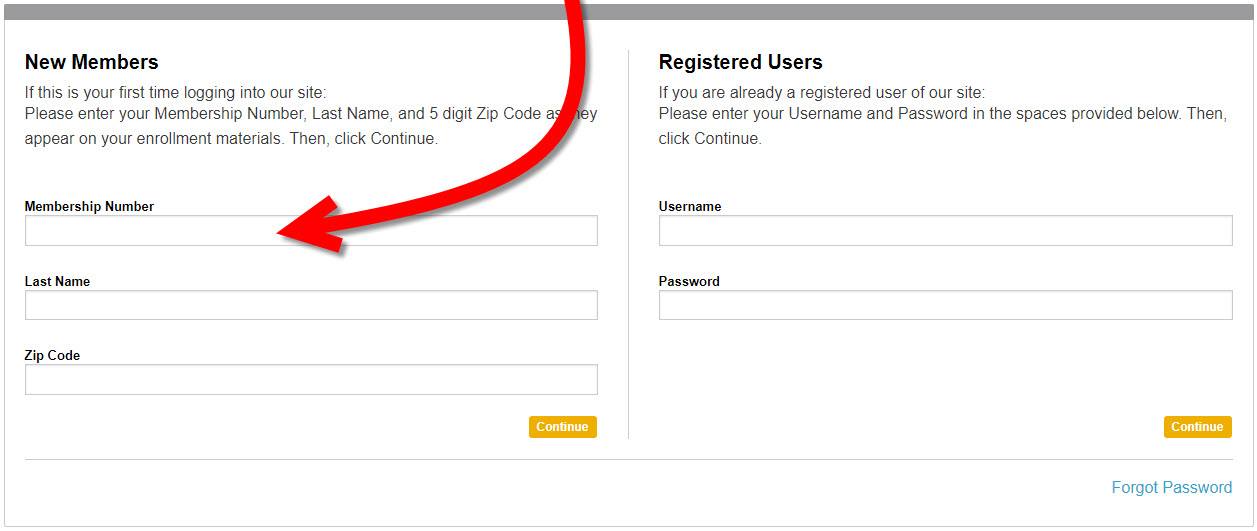

First Time User?

Using the ID TheftSmart Member ID provided by Riverview, complete the login form to continue.

Returning Visitors will enter through the right side if the site, using the User ID and Password created during initial setup.

Username/Password Page

This page will be pre-populated with information submitted on your Enrollment Application. You will need to fill out the missing required information.

This includes date of birth, social security number, and email address.

This includes date of birth, social security number, and email address.

You will then create a User ID and Password, as well as setup the Security Question.

Identity Validation Page

You will be required to answer three questions to validate their identity before receiving any credit alerts.

ID Theft Restoration

Restoration includes confirming fraud, investigating, and identifying its starting point. Even if you have a credit monitoring service already in place, consider this: the Federal Trade Commission estimates that it will take 6 months, 200 hours, and $1500 to restore your identity once it has been stolen. Kroll's ID TheftSmart is the only place you will get a full-service restoration of your identity, saving you time, money, and headache.

You will be assigned a personal investigator, who will:

- Investigate known, unknown & potentially complicated trails of fraudulent activity

- Organize details of issues & explaining your rights

- Initiate credit freezes on your behalf

- Make phone calls on your behalf

- Issue fraud alerts with:All three national credit bureau: Experian, TransUnion, and Equifax

- Social Security Administration (SSA)

- Federal Trade Commission (FTC)

- US Postal Service (USPS)

- Prepare appropriate documentation on your behalf

ID Integrity Scan

ID Integrity Scan is an early warning Online Fraud Detection service that performs regular searches of the Internet for your personal and financial information. If any suspicious activity is found, you will be immediately notified via email.

ID Integrity Scan allows you to:

- Monitor your name and Social Security numbers on millions of public records through a secure online registry

- Register personal identifying information such as address and credit card information to be found and removed from

- Internet directories at your discretion

- View the risk status of each tracked item on your personal Fraud Detection Dashboard

- Receive email alerts immediately if there is any change in the status of a tracked item

Credit Monitoring

Credit Monitoring will notify you of activity on your credit file. An alert is provided when any one of the following activities is reported:

- New account openings

- Credit inquiries

- Payment delinquencies

- Public record changes

- Change of address

Alerts are provided on a daily basis from the reporting agency. Notification of no activity is delivered on a monthly basis. Clients who select Single Bureau Credit Monitoring can choose to have alerts mails (via US Postal Delivery), on a quarterly basis. Credit Specialists are available 5am-5pm Pacific Standard Time (PST), Monday - Friday, excluding holidays.

ID Theft Counseling

Counseling includes one-on-one consultation and advocacy on your behalf. They will not only resolve known issues, but can also proactively identify and resolve previously unknown identity theft events.

You do not have to be a victim of identity theft to benefit from counseling from one of Kroll’s Fraud Investigators. If you have a concern about your identity, you have access to assistance and consultation.

Here are some of the ways Kroll can assist and provide guidance:

- How to secure your financial transactions

- What are the best practices for consumer privacy

- Methods to protect your personal information while shopping and communicating online

- Provide insight for preventing identity theft

- What are your consumer rights under federal and state law in the United States

- How does a parent safeguard the identity of a child who is a minor

- Discuss how to effectively shield a recently deceased family member from identity theft

- Assist you in the event of a stolen/lost wallet

- What to do if you receive a data breach notification letter indicating your information was compromised

- Consult in the event you receive abusive or harassing debt collection communication as a result of a stolen identity

- Help with interpreting and analyzing your credit report and other consumer reports